In the third quarter of 2024, sales of security cameras through online channels in China (including emerging e-commerce platforms such as Pinduoduo, Douyin, and Kuaishou) amounted to 7.8 million units, representing a year-on-year increase of 3.1%. The sales revenue reached 1.7 billion yuan, up 1.8% year-on-year.

Despite maintaining the double growth trend in both sales volume and sales revenue from the first half of the year, the growth momentum of the online market began to weaken significantly in that quarter, especially for traditional e-commerce platforms, where sales in July and August started to decline.

Table of Contents

Toggle

Sales Channels Divergence For Security Cameras:

The sales share of traditional e-commerce in the online market is 83.6%. In the third quarter of 2024, the scale of traditional e-commerce for security cameras in China declined for the first time, with sales volume reaching 6.52 million units, a slight year-on-year decrease of 0.3%, and sales revenue totaling 1.4 billion yuan, a year-on-year decrease of 2.2%. Amid the traffic dilemma, sales of half of the top 10 brands declined year-on-year.Emerging e-commerce platforms have maintained growth.

As mainstream brands such as Xiaomi, Ezviz, and Joann increase their investment in emerging channels, sales on emerging e-commerce platforms have achieved year-on-year growth exceeding 40%, accounting for about 16.4% of the market sales share of online channels overall.

Landscape Of Security Cameras Brands:

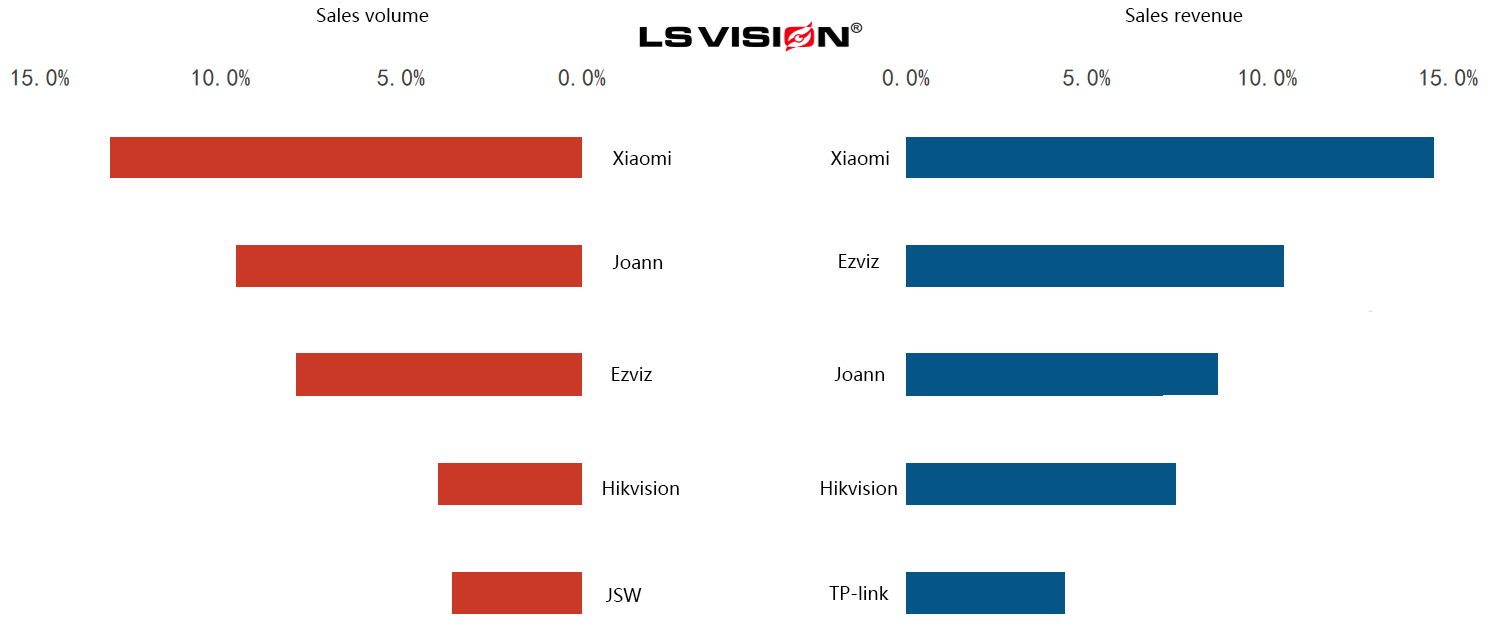

Xiaomi, Ezviz, Jooan, and Hikvision remain in the top four.

According to online omnichannel data, Xiaomi, Ezviz, Joaan, and Hikvision ranked top four in terms of sales volume and sales revenue in the online market in the third quarter of 2024, with a combined market share (CR4) of 36.7%.

Xiaomi ranked first in both sales volume and sales revenue across all online channels, with market shares of 13.1% and 14.6% respectively. In the third quarter, the promotions of multiple products such as the 3-camera version, C700, C300, and C500 had significant effects.

Ezviz ranked second in terms of sales revenue, with a market share of 10.4%. In the third quarter, more than 35% of Ezviz’s sales revenue came from emerging e-commerce platforms. Its product layout and sales strategies vary slightly across different channels. On traditional e-commerce platforms, Ezviz mainly promotes products such as C6C, C8C, and H9C; while on emerging e-commerce platforms, the battery-powered CB1 is more popular, accounting for more than 25% of the brand’s internal sales share.

Joaan ranked second in terms of sales volume, with a market share of 9.6%. Multi-camera products are Joaan’s main products. While further exploring differentiation, its two-way video call cameras have also started to increase in volume.

Hikvision’s efforts in the consumer market this quarter were evident, ranking fourth in both sales volume and sales revenue across all online channels. On emerging e-commerce platforms, Hikvision mainly promotes 4G outdoor cameras.

TP-Link and Haique performed prominently in the online mid-to-high-end market. Among them, TP-Link ranked fifth in terms of sales revenue, focusing on the price ranges of 150-250 yuan and 300-499 yuan. Haique, on the other hand, focuses on the 8-megapixel segment market and released a new product in the third quarter, emphasizing the upgrade to HiSilicon chips and permanent cloud storage services.

Haier, Aux, and other home appliance brands mainly promote low-to-mid-end products priced below 150 yuan. In the third quarter of 2024, both brands entered the TOP 20 list in terms of online sales volume.

Price Competition Among Security Camera Brands:

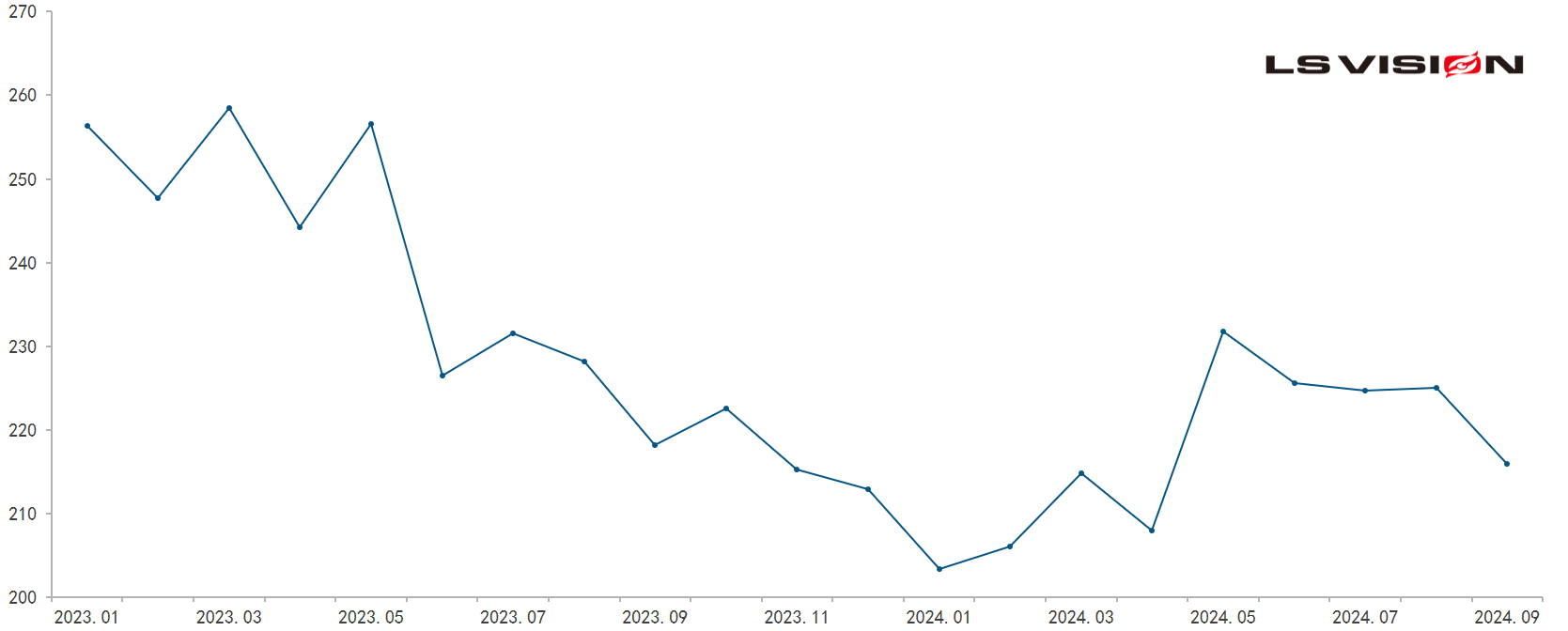

According to online data, the average price of security cameras on traditional e-commerce platforms has dropped from 256 yuan at the beginning of 2023 to 216 yuan in September 2024, with a cumulative decrease of over 15%.

Among the top 20 brands, over 80% have experienced a decrease in their average prices. Small and medium-sized brands have quickly profited from cost-effective products, while leading brands have successively joined the price war to maintain their market share.

Overall, the average price of 35% of the brands has dropped by more than 20 yuan.

Even the price reductions of popular products are noticeable. The average price of 5-megapixel cameras has dropped by 33 yuan to 207 yuan, while the average price of 8-megapixel cameras has fallen to 299 yuan, representing a decrease of nearly 30%.

Product Trends Of Security Cameras :

In 2024, the popular product forms of cameras in the consumer market are focused on three directions: gun-ball linked cameras, binocular and multi-eye cameras, and two-way video cameras.

According to traditional e-commerce data, in the third quarter of 2024, the sales of gun-ball linked cameras increased by more than 80% year-on-year, with a sales share reaching 20.7%, an increase of 9.4 percentage points compared to the same period last year.

In the third quarter of 2024, the total sales volume of binocular and multi-eye products on traditional e-commerce platforms exceeded 2 million units, with a year-on-year growth of nearly 60% and a sales share of 33.9%. At the same time, the penetration rate of two-way video cameras reached 2.3%, an increase of 2.1 percentage points year-on-year.

On emerging e-commerce platforms, two-way video cameras are also selling briskly due to their low pricing. According to emerging e-commerce data, from August to September 2024, the sales share of two-way video cameras on emerging e-commerce platforms exceeded 8%. Among them, the highest-selling product is priced below 100 yuan, which is 76 yuan lower than the average price of similar products on traditional e-commerce platforms.

In addition, some companies have launched binocular two-way video cameras, which add another camera component to the two-way video product, not only expanding the monitoring range but also enhancing social attributes.

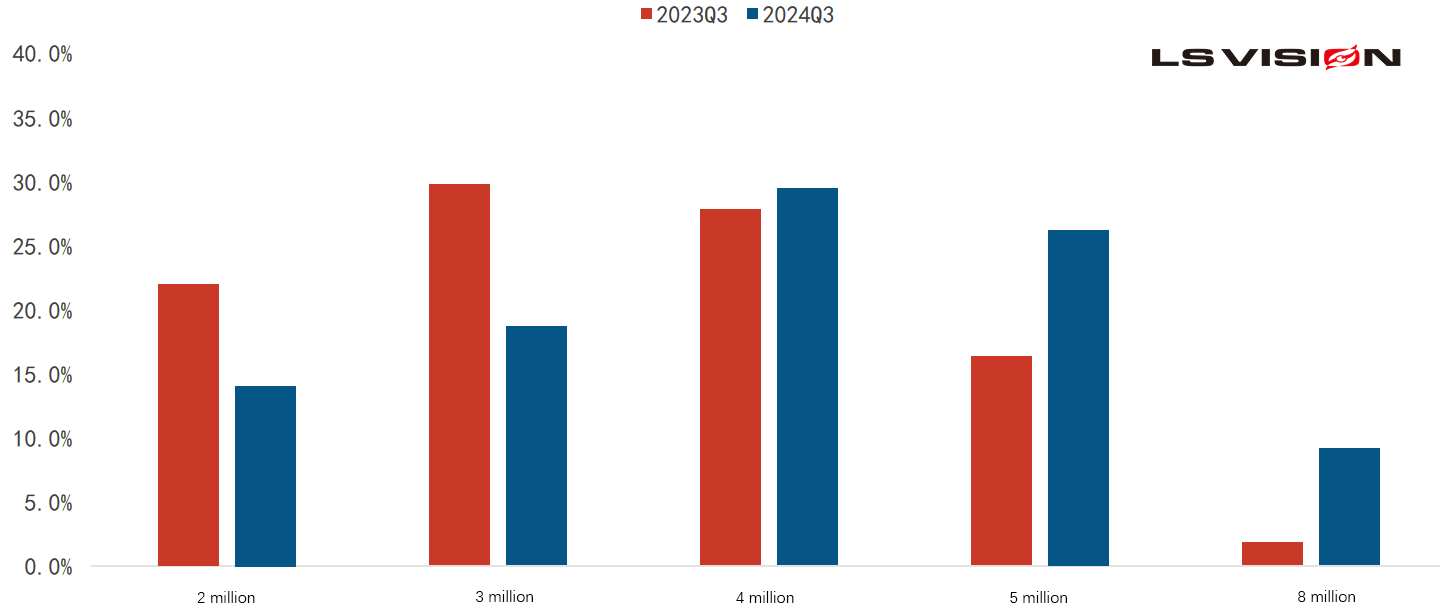

In terms of image quality, according to traditional e-commerce data, in the monocular camera market, the mainstream resolution has shifted from 2/3 megapixels to 4/5 megapixels. In the third quarter of 2024, the combined sales share of 4/5 megapixels reached 55.8%.

During the same period and under the same criteria, the sales share of 8-megapixel products increased by 7.4 percentage points to 9.2%.

New Technology Adoption:

The application of 4G networks in the consumer market for surveillance cameras is becoming more and more prominent. According to traditional e-commerce data, in the third quarter of 2024, the sales share of 4G cameras in the traditional e-commerce market was 14.1%, with a year-on-year increase of 2.4 percentage points. However, while the selling point of “buying products with lifetime free data” promoted by some brands is very eye-catching, it has also brought market chaos, including false advertising and hidden fees. Black light technology, applied in surveillance cameras, solves the problem of clear imaging under low illumination, ensuring the stability and reliability of monitoring. In 2024, the upstream, midstream, and downstream of the surveillance camera industry chain are all promoting the implementation of black light technology. Currently, it has been widely used in engineering channels, but its penetration rate in the consumer market is still less than 1%.

Market Forecast:

Entering the fourth quarter, influenced by the national policy focus, the overall market consumption environment has significantly improved. Coupled with the extended Double 11 promotion, it is expected that online sales of surveillance cameras will benefit from this. Perhaps the growth rate in the third quarter of this year will be the lowest for the entire year. It is predicted that in 2024, the sales volume of security cameras through online channels in China will reach 29.88 million units, with a year-on-year increase of 12%. Nevertheless, offline retail channels and operator markets will still be in an adjustment phase and continue to be sluggish. Therefore, if the statistical scope is broadened to include both online and offline channels, it is predicted that the overall sales volume of surveillance cameras in the Chinese market in 2024 will reach 56 million units, with a year-on-year increase of approximately 5%.